Building regression in excel. Regression in Excel: equation, examples. Linear regression

In my opinion, as a student, econometrics is one of the most applied sciences that I was able to get acquainted with within the walls of my university. With its help, it is indeed possible to solve applied problems on an enterprise scale. How effective these decisions will be is the third question. The bottom line is that most of the knowledge will remain theory, but econometrics and regression analysis are still worth studying with special attention.

What does regression explain?

Before we begin to consider the functions of MS Excel that allow us to solve these problems, I would like to explain to you in detail what regression analysis, in essence, involves. This will make it easier for you to pass the exam, and most importantly, it will be more interesting to study the subject.

Hopefully you are familiar with the concept of a function from mathematics. A function is the relationship between two variables. When one variable changes, something happens to another. We change X, and Y changes accordingly. Functions describe various laws. Knowing the function, we can substitute arbitrary values of X and see how Y changes.

This is of great importance because regression is an attempt to explain, at first glance, unsystematic and chaotic processes using a certain function. For example, it is possible to identify the relationship between the dollar exchange rate and unemployment in Russia.

If this pattern can be discovered, then using the function we obtained during the calculations, we will be able to make a forecast of what the unemployment rate will be at the Nth dollar exchange rate against the ruble.

This relationship will be called correlation. Regression analysis involves calculating a correlation coefficient that will explain the close relationship between the variables we are considering (the dollar exchange rate and the number of jobs).

This coefficient can be positive or negative. Its values range from -1 to 1. Accordingly, we can observe a high negative or positive correlation. If it is positive, then the increase in the dollar exchange rate will be followed by the creation of new jobs. If it is negative, it means that an increase in the exchange rate will be followed by a decrease in jobs.

There are several types of regression. It can be linear, parabolic, power, exponential, etc. We choose a model depending on which regression will correspond specifically to our case, which model will be as close as possible to our correlation. Let's look at this using an example problem and solve it in MS Excel.

Linear Regression in MS Excel

To solve linear regression problems, you will need the Data Analysis functionality. It may not be enabled for you, so you need to activate it.

- Click on the “File” button;

- Select the “Options” item;

- Click on the penultimate tab “Add-ons” on the left side;

- Below we will see the inscription “Management” and the “Go” button. Click on it;

- Check the box for “Analysis package”;

- Click “ok”.

Sample task

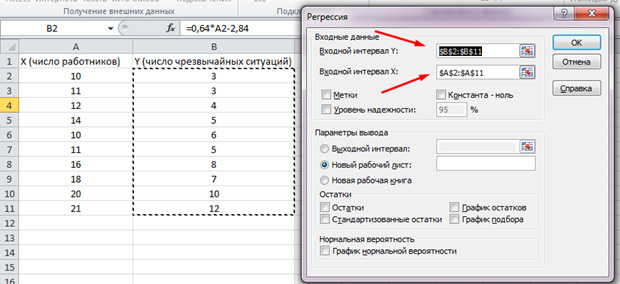

The batch analysis function is activated. Let's solve the following problem. We have a sample of data for several years on the number of emergency situations on the territory of the enterprise and the number of employed workers. We need to identify the relationship between these two variables. There is an explanatory variable X - this is the number of workers and an explanatory variable - Y - this is the number of emergency incidents. Let's distribute the source data into two columns.

Let's go to the “data” tab and select “Data analysis”

In the list that appears, select “Regression”. We select the appropriate values in the input intervals Y and X.

Click “Ok”. The analysis is completed, and we will see the results in a new sheet.

The most significant values for us are marked in the figure below.

Multiple R is the coefficient of determination. It has a complex calculation formula and shows how much you can trust our correlation coefficient. Accordingly, the higher this value, the more trust, the more successful our model as a whole.

Y-Intercept and X1-Intercept are our regression coefficients. As already mentioned, regression is a function, and it has certain coefficients. Thus, our function will look like: Y = 0.64*X-2.84.

What does this give us? This gives us the opportunity to make a forecast. Let's say we want to hire 25 workers for an enterprise and we need to roughly imagine what the number of emergency incidents will be. We substitute this value into our function and get the result Y = 0.64 * 25 – 2.84. We will have approximately 13 emergencies.

Let's see how it works. Take a look at the picture below. The function we obtained contains the actual values for the involved employees. See how close the values are to real players.

You can also build a correlation field by selecting the area of the Y's and X's, clicking on the "insert" tab and selecting the scatter plot.

The dots are scattered, but generally move upward, as if there is a straight line in the middle. And you can also add this line by going to the “Layout” tab in MS Excel and selecting “Trend Line”

Double-click on the line that appears and you will see what was mentioned earlier. You can change the regression type depending on what your correlation field looks like.

You may feel that the points draw a parabola rather than a straight line and that it would be better for you to choose a different type of regression.

Conclusion

Hopefully, this article has given you a greater understanding of what regression analysis is and why it is needed. All this is of great practical importance.

Regression analysis is one of the most popular methods of statistical research. It can be used to establish the degree of influence of independent variables on the dependent variable. Microsoft Excel has tools designed to perform this type of analysis. Let's look at what they are and how to use them.

But, in order to use the function that allows you to perform regression analysis, you first need to activate the Analysis Package. Only then the tools necessary for this procedure will appear on the Excel ribbon.

Now when we go to the tab "Data", on the ribbon in the toolbox "Analysis" we will see a new button - "Data Analysis".

Types of Regression Analysis

There are several types of regressions:

- parabolic;

- sedate;

- logarithmic;

- exponential;

- demonstrative;

- hyperbolic;

- linear regression.

We will talk in more detail about performing the last type of regression analysis in Excel later.

Linear Regression in Excel

Below, as an example, is a table showing the average daily air temperature outside and the number of store customers for the corresponding working day. Let's find out using regression analysis exactly how weather conditions in the form of air temperature can affect the attendance of a retail establishment.

The general linear regression equation is as follows: Y = a0 + a1x1 +...+akhk. In this formula Y means a variable, the influence of factors on which we are trying to study. In our case, this is the number of buyers. Meaning x are the various factors that influence a variable. Options a are regression coefficients. That is, they are the ones who determine the significance of a particular factor. Index k denotes the total number of these very factors.

Analysis results analysis

The results of the regression analysis are displayed in the form of a table in the place specified in the settings.

One of the main indicators is R-square. It indicates the quality of the model. In our case, this coefficient is 0.705 or about 70.5%. This is an acceptable level of quality. Dependency less than 0.5 is bad.

Another important indicator is located in the cell at the intersection of the line "Y-intersection" and column "Odds". This indicates what value Y will have, and in our case, this is the number of buyers, with all other factors equal to zero. In this table, this value is 58.04.

Value at the intersection of the graph "Variable X1" And "Odds" shows the level of dependence of Y on X. In our case, this is the level of dependence of the number of store customers on temperature. A coefficient of 1.31 is considered a fairly high influence indicator.

As you can see, using Microsoft Excel it is quite easy to create a regression analysis table. But only a trained person can work with the output data and understand its essence.

This is the most common way to show the dependence of some variable on others, for example, how does GDP level from the size foreign investment or from National Bank lending rate or from prices for key energy resources.

Modeling allows you to show the magnitude of this dependence (coefficients), thanks to which you can directly make a forecast and carry out some kind of planning based on these forecasts. Also, based on regression analysis, it is possible to make management decisions aimed at stimulating priority causes influencing the final result; the model itself will help to identify these priority factors.

General view of the linear regression model:

Y=a 0 +a 1 x 1 +...+a k x k

Where a - regression parameters (coefficients), x - influencing factors, k - number of model factors.

Initial data

Among the initial data, we need a certain set of data that would represent several consecutive or interconnected values of the final parameter Y (for example, GDP) and the same number of values of the indicators whose influence we are studying (for example, foreign investment).

The figure above shows a table with these same initial data; Y is an indicator of the economically active population, and the number of enterprises, the amount of investment in capital and household income are influencing factors, that is, X's.

Based on the figure, one can also make an erroneous conclusion that modeling can only be about time series, that is, moment series recorded sequentially in time, but this is not so; with the same success, one can model in the context of a structure, for example, the values indicated in the table can be broken down not by year, but by region.

To build adequate linear models, it is desirable that the source data do not have strong drops or collapses; in such cases, it is advisable to carry out smoothing, but we’ll talk about smoothing next time.

Analysis package

The parameters of a linear regression model can also be calculated manually using the Ordinary Least Squares Method (OLS), but this is quite time-consuming. This can be calculated a little faster using the same method by using formulas in Excel, where the program itself will do the calculations, but you will still have to enter the formulas manually.

Excel has an add-in Analysis package, which is quite a powerful tool to help the analyst. This toolkit, among other things, can calculate regression parameters using the same least squares method, in just a few clicks. In fact, how to use this tool will be discussed further.

Activate the Analysis Package

By default, this add-on is disabled and you won’t find it in the tab menu, so we’ll take a step-by-step look at how to activate it.

In Excel, at the top left, activate the tab File, in the menu that opens, look for the item Options and click on it.

In the window that opens, on the left, look for the item Add-ons and activate it, in this tab at the bottom there will be a drop-down control list, where by default it will be written Excel add-ins, there will be a button to the right of the drop-down list Go, you need to click on it.

A pop-up window will prompt you to select available add-ons; in it you need to check the box Analysis package and at the same time, just in case, Finding a solution(also a useful thing), and then confirm your choice by clicking on the button OK.

Instructions for finding linear regression parameters using the Analysis Package

After activating the Analysis Pack add-on, it will always be available in the main menu tab Data under the link Data Analysis

In the active tool window Data Analysis from the list of possibilities we search and select Regression

Next, a window will open for setting up and selecting source data for calculating the parameters of the regression model. Here you need to indicate the intervals of the initial data, namely the parameter being described (Y) and the factors influencing it (X), as shown in the figure below; the remaining parameters, in principle, are optional to configure.

After you have selected the source data and clicked the OK button, Excel produces calculations on a new sheet of the active workbook (unless it was set otherwise in the settings), these calculations look like this:

The key cells are filled with yellow; these are the ones you need to pay attention to first of all; the other parameters of significance are also important, but their detailed analysis probably requires a separate post.

So, 0,865 - This R 2- coefficient of determination, showing that 86.5% of the calculated parameters of the model, that is, the model itself, explain the dependence and changes in the parameter being studied - Y from the studied factors - X's. If exaggerated, then this is an indicator of the quality of the model and the higher it is, the better. It is clear that it cannot be more than 1 and is considered good when R 2 is above 0.8, and if it is less than 0.5, then the reasonableness of such a model can be safely questioned.

Now let's move on to model coefficients:

2079,85

- This a 0- a coefficient that shows what Y will be if all factors used in the model are equal to 0, it is understood that this is a dependence on other factors not described in the model;

-0,0056

- a 1- a coefficient that shows the weight of the influence of factor x 1 on Y, that is, the number of enterprises within a given model affects the indicator of the economically active population with a weight of only -0.0056 (a rather small degree of influence). The minus sign shows that this influence is negative, that is, the more enterprises, the less economically active population, no matter how paradoxical this may be in meaning;

-0,0026

- a 2- coefficient of influence of the volume of investments in capital on the size of the economically active population; according to the model, this influence is also negative;

0,0028

- a 3- coefficient of influence of population income on the size of the economically active population, here the influence is positive, that is, according to the model, an increase in income will contribute to an increase in the size of the economically active population.

Let's collect the calculated coefficients into the model:

Y = 2079.85 - 0.0056x 1 - 0.0026x 2 + 0.0028x 3

Actually, this is a linear regression model, which for the initial data used in the example looks exactly like this.

Model estimates and forecast

As we have already discussed above, the model is built not only to show the magnitude of the dependence of the parameter being studied on the influencing factors, but also so that, knowing these influencing factors, it is possible to make a forecast. Making this forecast is quite simple; you just need to substitute the values of the influencing factors in place of the corresponding X's in the resulting model equation. In the figure below, these calculations are made in Excel in a separate column.

The actual values (those that occurred in reality) and the calculated values according to the model in the same figure are displayed in the form of graphs to show the difference, and therefore the error of the model.

I repeat once again, in order to make a forecast using a model, it is necessary that there are known influencing factors, and if we are talking about a time series and, accordingly, a forecast for the future, for example, for the next year or month, then it is not always possible to find out what the influencing factors will be in this very future. In such cases, it is also necessary to make a forecast for the influencing factors; most often this is done using an autoregressive model - a model in which the influencing factors are the object under study and time, that is, the dependence of the indicator on what it was in the past is modeled.

We will look at how to build an autoregressive model in the next article, but now let’s assume that we know what the values of the influencing factors will be in the future period (in the example, 2008), and by substituting these values into the calculations we will get our forecast for 2008.

The MS Excel package allows you to do most of the work very quickly when constructing a linear regression equation. It is important to understand how to interpret the results obtained. To build a regression model, you must select Tools\Data Analysis\Regression (in Excel 2007 this mode is in the Data/Data Analysis/Regression block). Then copy the results into a block for analysis.