The best offer for Android expense accounting. Family budget accounting: the best accounting program

The best way become frugal - get into the habit of taking into account your expenses and income. The easiest way to do this is by installing on Android special application. You will enter all your daily expenses and income into it, as a result of which you will be able to understand where your money is going. Below we will talk about such programs.

It should be noted that the ideal in terms of such utilities is Excel and special skills in working with it. Some computer programs designed for Windows also perform well. Well, as for mobile applications, their functionality is still somewhat limited. That's why you won't see maximum ratings in this article today.

Price: Free

The best option for owners of smartphones with a display created using Super technology AMOLED. This is explained by the fact that the text here is written in white on black. As for the functionality of the program, it assumes complete control of expenses and income. At the same time, you can open not one account, but several. This is especially true if you have several bank cards and electronic wallets. The application allows you to maintain accounts in different currencies, automatically converting amounts into your home currency.

Very useful function Financisto can be called recurring transactions. You don't need to enter them yourself - the program will take care of it for you. Well, in the “Reports” tab you can find a variety of statistics. It can be presented as in text form, and in the form of charts and graphs. All data from this financial accounting program for Android can be copied to cloud storage. There they are saved in the form of a QIF or CSV file.

Advantages:

- Russian-language interface;

- Opportunity backup;

- Accounting not only for income, but also for expenses;

- Detailed reports;

- Automatic conversion of amounts from one currency to another;

- Support for recurring transactions.

Flaws:

- Beginners find the application difficult;

- Very simple interface design;

- It is not recommended to install on a memory card.

Mofix

Price: Free

The Russian-language name of this utility immediately conveys its essence. Personal finances are taken into account here. Excel format. You can easily save the file, send it to your computer or print it. It seems that the product is intended for advanced users. The fact is that the interface available here can be called minimalistic. However, it does not contain any hints.

The creators of Mofix clearly haven’t heard of automatic currency conversion. Therefore, you will have to use a financial calculator if you suddenly made some kind of intercurrency transaction. Surprising, but very simple program received SMS reading function. If the message comes from the bank, it is automatically processed - the data from it is immediately entered into financial accounting. Very convenient. Although, of course, you will still have to make most of the entries manually. Especially if you use cash most of all.

Unfortunately, you shouldn't expect any special features from this application. If you want to see charts and graphs in reports, then you should definitely look at some other product from our selection. However, we must not forget that you can build diagrams yourself, in the same Excel.

Advantages:

- Quickly add income and expenses;

- Russian-language localization;

- Automatic processing of incoming SMS from the bank;

- Ability to save the file in XLSX format;

- Synchronization with Dropbox cloud storage.

Flaws:

- The program is not for those who do not use Excel at all;

- Very simple interface;

- Not the best reports.

Alzex Finance

Price: Free

A wonderful application that allows you to control both expenses and income. You should start using the program by creating invoices. For example, this could be a bank card (or even several), cash and some kind of savings account. All that remains is to enter transactions. And you don’t have to do it manually - you can download the “Check Checks” application from the Federal Tax Service of Russia, sending the results of scanning QR codes in JSON format.

The program helps you monitor your budget. For example, you can set a limit on spending on groceries - the application will warn you when you are approaching the threshold. You can use Alzex Finance to save for some major purchases. The creators have not forgotten all kinds of reports. Using the corresponding section, you can view information about any categories of income and expenses for absolutely any period.

Alzex Finance is not an application for beginners. The program was created for those who intend to seriously monitor the family budget. In this regard, you should not be surprised that the application is only free trial period. In the future, you will have to pay a certain amount. By the way, the utility can synchronize data with a cloud service. Thus, you can keep track of income and expenses using the mobile and computer versions of Alzex Finance at the same time. It's a shame what the computer program you will also have to pay.

Advantages:

- Accounting for income and expenses of several family members;

- Ability to create hidden expense categories;

- Detailed reports;

- It is possible to create both transactions and checks;

- Regularly updated exchange rates;

- You can receive data from the “Receipt Check” application;

- Convenient budget planning;

- Synchronization with Dropbox and Google Drive.

Flaws:

- The set of icons for categories is not too large;

- You will have to pay to use the application;

- Sync with computer version only through a third-party cloud.

Price: Free

Already a little more advanced expense accounting for Android. In addition, of course, the program also keeps income statistics, which can also be very useful. Downloading the utility is recommended for those who like to customize the interface for themselves. The fact is that the main page here is easily modified. You can display cards with exactly the information that is most important to you.

As with all other applications, the user can create multiple accounts. You can even set an expiration date for the invoice. Of course, different currencies are not forgotten here; their rates are even regularly sent from the server. However, automatic exchange is not available. If you need to perform such an operation, you will need a calculator. But there is support for recurring transactions, and this is sometimes much more important.

Another important feature of ViZi is the ability to create a financial goal. Although in fact this is the same account, the progress of which can be monitored, so don’t expect anything unusual. The program is also able to save all reports in a CSV file. And if you buy paid version ViZi, you will additionally receive the synchronization function with the “cloud”.

Advantages:

- Availability of widgets;

- Support for recurring transactions;

- Nice interface (design themes available);

- Russian-language localization;

- Good reports in the form of tables and diagrams;

- Saving the file in CSV format;

- Backup (in PRO version);

- Possibility to set a financial goal.

Flaws:

- Inability to automatically exchange one currency for another;

Money Lover

Price: Free

Another free financial accounting for Android. Although we must admit that some functionality here is only available for money. In particular, this concerns the ability to save the file in XLS format.

Most of all, the utility pleases with its simplified interface. Money Lover in this regard is similar to Evernote, which is now installed on almost every smartphone. However, under simple interface A very wide functionality is hidden here. Even a simple addition new operation here it is furnished in such a way that you can choose not only a wallet, but also related contact, event and many other parameters. All this benefits further reporting. Which, by the way, looks great, it is close to a full-fledged infographic.

Main advantage Money Lover over other competitors existing on operating system Android, is the “Planning” section. Here you can not only set a financial goal, but also set the maximum expenses for a particular event. If the mark is exceeded, the application will definitely notify you about it. Very useful, for example, in case of traveling or preparing for a wedding.

Advantages:

- Rich planning capabilities;

- Save file in CSV or XLS format;

- Backup function;

- Keeps records of not only income, but also expenses;

- Beautiful and informative reports;

- Russian localization;

- Nice and intuitive interface.

Flaws:

- Lack of online currency converter;

- There is no recognition of SMS from the bank.

Summing up

So we looked at the best expense accounting programs for Android. Using any of them, you can track your finances, which will certainly lead to certain conclusions. For example, this way you can find out that you spend too much money on cosmetics or something more useless.

It should be noted that the considered best apps are very different from each other. If you want to get serious about accounting for finances, then it’s better to download it to your smartphone Money Lover. This is one of the most advanced utilities. Although no less respect is given to Financisto. A Mofix surprises with the recognition of SMS from banks, as a result of which many transactions are added to the appropriate list automatically. But otherwise this utility is too complex to understand. If you want to get a simple application, then it’s better to look away. It will not allow you to get confused in the interface, offering quite good functionality. Much the same can be said about Financius, although in terms of capabilities this program is still inferior to its competitors.

Price: basic version – free, premium – 149 rubles. per month.

The first thing you can immediately love about CoinKeeper is that there is no need to register. No names, dates of birth or connection to social networks– immediately open the application and start using it.

CoinKeeper's interface is simple, with your wallets at the top of the main menu and spending categories at the bottom. Default expenses include groceries, transportation, eating out, housekeeping, entertainment, and services. If this division does not suit you, you can add new categories, delete old ones and change their places.

To add an expense entry, simply swipe from your wallet to the desired category. After this, you can indicate the amount spent, add a comment, select a date and indicate the frequency of payment. However, if you do not have the time or desire to write in such detail, it is enough to limit yourself to just entering numbers.

CoinKeeper also has statistics on expenses and income, which can be viewed by month or day. The application provides statistics in the form of graphs and charts, which is very convenient.

Cash Organizer

Price: basic version – free, premium package – 249 rubles. per month.

After downloading Cash Organizer, you can immediately synchronize the application with your bank: this will save you from manual entry. You don’t have to worry about the security of your accounts - the application is protected by an SMS password, and also has a security system in which even developers cannot access your data.

Cash Organizer's interface is not as simple as CoinKeeper's, but it is quite convenient. If difficulties with use still arise, you can open the instructions directly in the application.

Besides standard features similar IT accountants, for example, statistics, reports, budget planning columns, Cash Organizer has a function for maintaining a joint account. It is convenient to maintain a joint account with your spouse or financial partner so that you can see where the money is going in real time. If necessary, you can use the “split check” function - then the expenses of one person in different categories will immediately become visible.

The application is available for IOS and Android, and there are also web versions for Mac and Windows.

Debit & Credit

Price: basic version – free, premium – 299 rubles.

Another beautiful and simple application. Debit & Credit combines the simplicity of the CoinKeeper interface and the wide functionality of Cash Organizer.

The developers of Debit & Credit are proud high speed, with which you can create transactions. They assure that manual entry will not take more than five seconds, and the new updated version also has support. To create an expense, you can say: “Siri, pay my check for 100 rubles in Debit&Credit.”

One interesting thing is that the application has a function for scheduling bill payments in the future: you need to enter the date and amount of payment, and the application will remind you of the payment with a notification.

In addition, you can reconcile your transactions with the bank. Reconciliation mode minimizes possible errors and allows you to better control spending.

Money Lover

Price: Basic version is free, premium is $5 one time.

To use the application you need to indicate email or log in using or . This does not take much time, but it is necessary that all data is saved in the cloud and synchronized with other devices.

I'm pleased with the intuitiveness of the application: home page At the bottom there are three icons - operations, report, planning and the “add operation” button. I'm not happy with the advertising under the icons. You can get rid of it only by purchasing the Premium version. However, a small advertisement does not interfere with using the application, but free version already rich in functions.

Hidden under the “more” button are useful tools: finding ATMs and banks nearby, a tip calculator, and scanning receipts. And if circumstances forced you to borrow money, then this figure can be entered in the “debts” tab. The tab can help maintain your relationships with friends and family if you suddenly forget about your loan.

The application is popular with Android users, but is also available to iPhone lovers, and also has a web version.

Split

Price: for free.

Split will be appreciated by those who live in a hostel or rent an apartment with friends. The application was created to control joint expenses for an apartment, public utilities or products. To use it effectively, you need to add all participants, and everyone will be able to create their own transactions. Split determines the balance of each account participant and records who owes whom and how much. Especially for those who are forgetful, the application sends balance sheet results and debt calculations by e-mail. This will help save time and avoid a showdown.

However, the application can be used alone - all its functions are suitable for this.

The updated version of the application has the ability to synchronize expense accounts for different devices. It's nice that this can be done without creating a special account.

Looking for free programs For home accounting? Then you've come to the right place.

Maintaining home accounting is the success of maintaining wealth in the family.

You can control your income and expenses the old fashioned way, i.e. in the notebook and modern methods, by installing the appropriate software on your PC.

In particular, we will consider the 5 most convenient and widespread programs for these purposes.

- HomeBank;

- Family Budget Lite;

- Family Accounting;

- CashFly;

- Home Accounting Lite.

HomeBank

Free app allowing you to keep track of your finances.

Using the software, you can fully control your income and expenses, plan your family budget, analyze expenses and more. Take complete control of your spending.

The program supports tight integration and import of data from Microsoft services Money and Quicken, as well as other applications for managing your own funds.

Supports QIF, QFX, CSV and OFX formats.

The functions include detection of duplicate transactions. This allows you to avoid confusion in calculations and clutter in the database.

Pay attention! Transactions can be organized into categories. You can also plan automatic addition incoming transactions into the created database, adding various tags and more. There is also a function that allows you to edit several fields at once, which significantly speeds up and simplifies the accounting process.

Set annual or monthly budget levels for each category as needed.

Generate dynamic reporting, reflecting the current state of your financial situation. If necessary, they can be provided with diagrams for clarity.

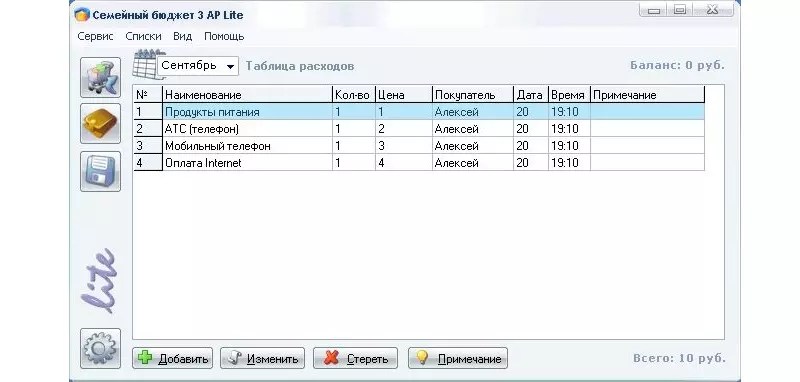

Family Budget Lite

This program is designed to relieve your agony regarding counting personal expenses. All you need to do is enter your own income and expenses in the appropriate columns.

The program will perform all other operations independently.

The client benefits are as follows:

- profitability for several main categories and accounts is taken into account;

- you can account for your own debts, loans, investments, deposits and other calculations;

- you can use the auto-category function, i.e. when entering product names, the program will automatically select the required category from the table;

- detailed report of 8 parts in one click;

- export to HTML, BMP, TXT, Word and . It is also possible to print and save the document.

The client can be used by several people at the same time. In this case, everyone will have their own account and password.

The latter can be installed when the application starts.

Searching for income and expenses is very convenient, since it is possible to customize the results using several filters at once: product, date, category, etc.

Accounting Family

If you don't want to systematically wonder where your money is constantly going, use this program.

You don’t have to speculate and remember where the money went, which was put aside for so long for an important purchase, but at a critical moment it took it and evaporated in the literal sense of the word.

The program will allow you not only to analyze, but also to control revenue. You will also be able to plan your own expenses by thinking through your budget more carefully.

The client has enough options:

- accounting of income and expenses;

- accounting of debts (both borrowed and borrowed);

- analysis financial transactions;

- Possibility of accounting in different currencies.

CashFly is a simple and very convenient end user program for recording personal financial transactions.

You can create multi-level structures displaying income and expense items.

It is also possible to build charts of varying degrees of complexity, based on previously entered data and other financial information that is important to you.

It provides address book, a list of organizations, as well as personal diary, which allows you to record reminders about events that are important to you.

The application is capable of keeping records in almost any given currency, performing scheduled calculation operations and printing data.

Databases are password protected for greater reliability and security of content.

On the Russian-language Internet? Because we love to save. And we want you to save too!

Therefore, we made an objective and honest review the most convenient smartphone applications for managing your home budget. Let's go!

AndroMoney

- Developer: AndroMoney

- Price: Free – Google Play

A distinctive feature of the application is the option to set a budget for a day, month, year, or even a separate budget for a selected time category.

The AndroMoney application can create backup copies of your budgets, while saving them to a memory card, or cloud storage. Also, if desired, the report is converted into CVS format and it is possible to continue working with it on a personal computer.

The advantages of this program include:

- Intuitive and clear interface;

- Flexible functionality and a lot of settings;

- Option to create backups;

- Converting to CVS format for working with information on a PC;

- User-data password protection

According to user reviews, no obvious disadvantages were found.

Expense Manager

- Group: financial instruments

- Developer: Bishinews

- Price: Free – Google Play

- Pro version for $5 – Google Play

Expense Manager - an application developed by Bishinews - is popular among users - five million users! The functionality of the application is huge, but the main function is financial planning.

When launching the application, users are presented with a template with several expense items, which can be changed if desired by going to the “settings” menu. You can also quickly view the required payments or study a detailed and visual expense schedule. Like AndroMoney, Expense Manager will easily do backup copy reports to the cloud Dropbox storage or the device's memory card.

A distinctive feature is the presence of a built-in currency converter. Functionality free option Expense Manager is enough to manage your personal expenses.

Pros:

- Intuitive ergonomic interface;

- Many useful functions;

- View reports in graph idea;

- Data backup;

- Currency converter (only if you have an Internet connection).

Well, from the minuses:

- Incomplete functionality of the free version of the application;

- Lack of Russian language

"Family Budget"

- Group: financial instruments

- Developer: Maloi

- Price: Free – Google Play

"Family Budget" - official mobile client for Android, which exactly replicates the functionality of the popular web service for accounting. The application turned out to be no less simple and convenient, and the presence of extensive functionality makes it easy to monitor the family’s financial affairs from a mobile device.

Each generated report is optionally presented in the form of graphs that clearly display necessary information on spending money.

Pros:

- Interface;

- Maximum settings;

- Synchronization with the service;

- Visual display of reports in the idea of graphs.

- Version of the service for a personal computer

Cons:

- Availability of advertising (can be disabled only for money);

- Backup to device memory card only.

EasyMoney

- Group: financial instruments

- Developer: Handy Apps Inc

- Price: Free – Google Play

- Pro version for $10 – Google Play

EasyMoney is the most expensive and most functional application in this category of applications. However, there is a free version of the program and you can test the initial functionality on it, and only then decide whether it’s worth spending money on full version applications.

Some of the interesting things in the program include: displaying interactive reports and charts, maintaining several accounts in foreign currency, maintaining home budget and monitoring investments and plastic card balances.

With the data backup feature, you don't have to worry about saving your reports safely.

You can easily transfer all the work done to a memory card or export reports in QIF CSV format.

Pros:

- Impressive functionality;

- Visual reports in the form of interactive graphs;

- Transferring ready-made answers to a memory card;

- Availability of a widget on the desktop.

Cons:

- Complicated interface;

- Lack of Russian language;

- Not cheap!

CoinKeeper

- Group: financial instruments

- Developer: IQT Ltd

- Price: Free for the first 15 days - Google Play

CoinKeeper is a popular application for keeping track of expenses and income on an Android smartphone or tablet. After the first launch, the application will prompt you to select the appropriate income planning method: automatic (in this case, the amount of monthly income is indicated) or manual (requires separate setting each of the parameters).

Each of the main menu items has a clear and visual explanation. Categories are color-coded and separated by special icons, which can be adjusted if desired.

Among the functions of the program, I would like to note a serious number of accounts (not limited by the program), adding another expense transaction in a couple of seconds, icons display the current expenses of flowers and in case of overspending cash will change color, financial goals, backup information to a memory card or cloud storage, as well as password protection.

Pros:

- Ergonomics and intuitiveness of interfaces - operations are implemented by dragging one icon onto another;

- Hints;

- Automatic budget planning;

- Data backup;

- Automatic transfer of information to other devices;

- Setting a password.

Of the minuses, we note:

- Small number of financial reports;

- Slow animation that lags even on modern devices

- There is no "desktop" version of the program

"Home accounting"

- Group: financial instruments

- Developer: Keepsoft

- Price: 4$ – Google Play

“Home Accounting” is the last application in today’s review for maintaining accounting records on mobile device. It implements the maintenance of both personal financial records and family budget. No special accounting knowledge is required, the application is easy to use, and thanks to the “tasty” filling and a large number functions, using the application is frankly a pleasure.

An interesting feature of the “Home Accounting” program is that several users can use the application at once (each logs in under their own name).

Pros:

- Intuitive interface;

- Russian localization;

- Each category is marked with a separate icon;

- Backup information;

- Exceptional functionality;

- Clear reports;

- Setting a password for the application;

- Availability of a “desktop” version of the application for keeping records on a PC and prompt exchange of information.

Obvious disadvantages“Home Accounting” was not found by users.

Whatever application you install, do not forget to add “cashback from” to your income item. And we will ensure that you have a constant surplus on this item;)

Markswebb Rank & Report, at the request of RBC Money, tested 11 of the most popular Russian-language applications for control and planning personal budget and chose the best

The first step to saving money is to analyze your own spending, financial advisors say. The most convenient way to do this is with the help of PFM (Personal Financial Management) services, which automatically evaluate your expenses and present them in a form convenient for analysis. Russian PFM applications can be divided into two groups: banking applications built into online banks, and services from independent developers.

The problem with banking applications is that in most cases they analyze expenses on accounts and cards in a particular bank, while most Russians usually use the services of several credit institutions, and often spend cash. However, in some bank applications (for example, Sberbank, Alfa Bank and Russian Standard) you can manually enter expenses in cash.

Banking applications are essentially just an addition to online banks. Therefore, we decided to evaluate independent applications for controlling personal finances. They can be used by anyone without being tied to specific banks. At the request of RBC Quote, the Markswebb Rank & Report agency selected the most popular apps on home accounting for iOS and Android platforms and tested them. Web versions of services were not evaluated (see table for detailed methodology).

Manual control

The key disadvantage of independent mobile PFM services is the need to enter most of the data manually. For example, none of the application developers analyzed by Markswebb Rank & Report were able to properly recognize bank SMS messages about transactions. Domestic Easy Finance and Zen-Money went further than others.

Both programs allow you to import bank statements in several formats. True, entering this data is only possible in synchronization with mobile application web versions. Moreover, the RBC Quote correspondent on the Easy Finance website did not manage to do this correctly the first time.

And in order to set up automatic entry of transactions in the Zen Money application, you need to set up redirection emails bank about completed transactions to the e-mail provided by the developers of this project. Thus, you can automatically enter card transactions from, for example, Citibank, VTB24, and Bank St. Petersburg into the application. In total, the service offers synchronization of expense data in one way or another with eight banks.

The MoneyWiz and Money Pro applications developed in the West allow you to import bank statement data in the OFX (open financial exchange) format, which evolved from the financial exchange format. Microsoft data. It is quite popular among American and European banks, but is rarely found in Russia. Although, for example, Raiffeisenbank makes it possible to download account statements in three formats, including OFX.

"Zen Mani"

In other applications, you will have to create “accounts” corresponding to bank accounts, into which you need to independently enter data on income and expenses. In some, you can account for expenses and income in cash, according to bank cards, deposits and other financial products.

The most complete and convenient options for setting up accounts are offered by the Zen Money and Money Pro services, according to Markswebb Rank & Report. Other apps, like Spender and Spendee, track all expenses without linking them to specific accounts. Such applications, according to Markswebb Rank & Report, will be convenient for those who primarily use cash and do not use bank cards.

All applications have a default list of expense categories, which can be edited by adding new categories and removing unnecessary ones. Based on test results, Markswebb Rank & Report considers the most convenient applications for setting up categories and subcategories of expenses (for example, in the “Car” category - the ability to create new subcategories “Service”, “Gasoline”, “Insurance”, etc.) CoinKeeper, Home Budget, MoneyWiz and Money Pro.

CoinKeeper

MoneyWiz and Money Pro, among other things, allow you to divide the transaction amount into parts tied to different categories of expenses (for example, the amount spent in a supermarket can be divided into several categories). You can also add comments and photos to an expense transaction.

MoneyWiz

Cost Analysis

The most complete and convenient opportunities for visualization and analysis of collected expense data, according to Markswebb Rank & Report, are offered by the CoinKeeper and Spendee applications - in them you can see the distribution of expenses by category in the form pie chart, you can track the dynamics of expenses by month, by individual categories.

In terms of the ability to export expense data, backup and synchronize data with other devices, the most functional applications are Home Budget, “My Money with Money” and MoneyWiz, according to Markswebb Rank & Report.

“In the end, we found five services to be the most convenient and visually attractive,” says Alexey Skobelev, CEO of Markswebb Rank & Report. Here they are:

— Spendee Suitable for students and those who practically do not use banking services.

— “Zen Money” and CoinKeeper- attractive and convenient applications For simple accounting expenses. Suitable for those who use cash and several bank cards at the same time.

— MoneyWiz and Money Pro- complex applications with a large number settings. Suitable for those for whom a variety of functions is more important than convenience.

In addition to analyzing expenses, applications often ask you to set certain goals - to save the necessary amount of money, for example, for a car, or to create a financial “cushion” for six months. Application developers (in in this case Easy Finance) have fully absorbed the advice of financial advisors. This one - about the need to have enough money for six months of comfortable existence just in case - is one of the most favorite.

As well as advice to monitor your expenses. General manager Personal Advisor Natalya Smirnova says she asks her clients to provide income and expense reports two to four times a year to track their financial health. But to achieve long-term goals, she creates an individual plan.

Money Pro

PFM services - useful tool to analyze and minimize daily expenses, but to save for long-term financial goals, they are not enough, agrees Anton Graborov, director of customer service for the BCS financial group. “You need not only to save, but also to understand how to properly invest the accumulated funds. This question is answered by personal financial planning, which analyzes a person’s individual financial situation,” he says.

So far, PFM services are not very popular among Russians. According to the Managing Director for e-business Promsvyazbank Algirdas Šakmanas, bank service for planning personal budget “Smart Money” is connected by every fifth Internet banking user. The “My Expenses” service, which became available to users of the Alfa-Click Internet bank in December 2013, is used monthly by 12% of clients, says Yuri, head of the development and innovation department of the Alfa-Bank Internet bank. Chernyshev.